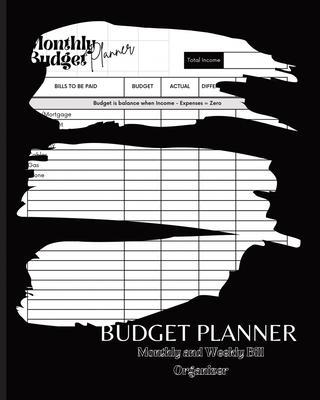

Budget Planner: Twelve Months Financial Organizer, Monthly and Weekly Budget Planner, Bill Payment, Expenses Tracker with Subscription

Budget Planner: Twelve Months Financial Organizer, Monthly and Weekly Budget Planner, Bill Payment, Expenses Tracker with Subscription

Introducing our comprehensive budget planner, designed to help you take control of your finances and achieve your financial goals. Our budget planner includes features like a subscription tracker, debt tracker, weekly paycheck budget, and debt snowball log.

With our budget planner, you can start your journey to financial freedom and achieve your financial goals, whether it's paying off debt, saving for a down payment on a home, or simply managing your money more effectively.

Budget for the Week: The weekly budget feature helps you plan your budget around your income, allowing you to better manage your expenses and avoid overspending. With this fweekly budget worksheet, you can allocate your income for the week towards your expenses and savings goals for that week and keep track of partial bill payment if one is being made. A great feature that helps you tailor your income to match your lifestyle.

Track Subscription: Our subscription tracker helps you to easily keep track of your recurring expenses, such as gym memberships, streaming services, and other subscriptions. This feature helps you identify areas where you may be overspending and make adjustments to your budget accordingly.

Debt List: Our debt tracker allows you to monitor your progress in paying off your debts especially bad debts. You can track your debt with the debt list worksheet then start the snowball debt pay down with the snowball worksheet. The debt snowball log sheet helps you pay off your debts systematically. By prioritizing your debts based on interest rate and balance owed.

PRP: 107.38 Lei

Acesta este Prețul Recomandat de Producător. Prețul de vânzare al produsului este afișat mai jos.

96.64Lei

96.64Lei

107.38 LeiLivrare in 2-4 saptamani

Descrierea produsului

Introducing our comprehensive budget planner, designed to help you take control of your finances and achieve your financial goals. Our budget planner includes features like a subscription tracker, debt tracker, weekly paycheck budget, and debt snowball log.

With our budget planner, you can start your journey to financial freedom and achieve your financial goals, whether it's paying off debt, saving for a down payment on a home, or simply managing your money more effectively.

Budget for the Week: The weekly budget feature helps you plan your budget around your income, allowing you to better manage your expenses and avoid overspending. With this fweekly budget worksheet, you can allocate your income for the week towards your expenses and savings goals for that week and keep track of partial bill payment if one is being made. A great feature that helps you tailor your income to match your lifestyle.

Track Subscription: Our subscription tracker helps you to easily keep track of your recurring expenses, such as gym memberships, streaming services, and other subscriptions. This feature helps you identify areas where you may be overspending and make adjustments to your budget accordingly.

Debt List: Our debt tracker allows you to monitor your progress in paying off your debts especially bad debts. You can track your debt with the debt list worksheet then start the snowball debt pay down with the snowball worksheet. The debt snowball log sheet helps you pay off your debts systematically. By prioritizing your debts based on interest rate and balance owed.

Detaliile produsului