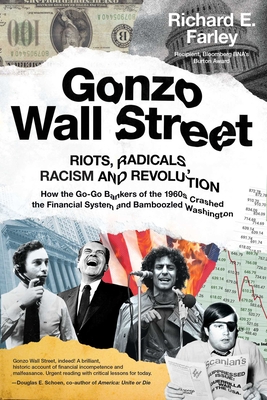

Gonzo Wall Street: Riots, Radicals, Racism and Revolution: How the Go-Go Bankers of the 1960s Crashed the Financial System and Bamboozled

Gonzo Wall Street: Riots, Radicals, Racism and Revolution: How the Go-Go Bankers of the 1960s Crashed the Financial System and Bamboozled

The long-hidden history of how the corrupt Wall Street investment banks of the 1960s held Congress over a barrel and got an outrageous taxpayer-funded bailout of what they owed their customers--and how little Congress and the SEC got from Wall Street in return. This set the precedent for the bailouts of the 2008 Financial Crisis--and the next Wall Street bailout. A story of corruption and financial malfeasance, it unfolds throughout the tumultuous 1960s, during the administrations of Kennedy, Johnson, and Nixon with a surprising cast of famous and infamous characters playing roles: Abbie Hoffman, Roy Cohn, Ross Perot, Donald Regan, Michael Bloomberg, Felix Rohaytn, Sandy Weill, Ken Langone, and many others. In the 1960s, the fabric of American society was torn apart by deep divisions over the Vietnam War, violence in our cities, and the senseless assassinations of President John F. Kennedy, Martin Luther King Jr., and Senator Robert Kennedy. Civil rights, as well as women's and gay liberation movements, were challenging America. Music, literature, fashion, and "substances" were transforming the culture and upending conventional morality and manners. The public, the media, and politicians, preoccupied with these dramatic changes, paid little attention to Wall Street, where a crisis was brewing that would cause more investment banks to fail than during the Great Depression. The year 1968 should have been the best of times on Wall Street. It was the greatest bull market since the Roaring '20s. The Dow was breaking records. Trading volume was exploding. A hot IPO market for high-flying technology companies was defying gravity. And a swashbuckling mergers and acquisitions wave was generating enormous profits. Despite how flush Wall Street firms looked to outsiders, in truth, they were not a thundering herd but one in need of culling. Hidden from view was the fact that many of the best-known firms on Wall Street were in very precarious financial positions. Rather than investing in desperately needed state-of-the-art computer systems, the executives of these firms overpaid themselves, leaving them overextended and overleveraged. When business exploded in 1968, they were so overwhelmed by the stacks of stock certificates piled from floor to ceiling that their antiquated back offices were unable to process them. The New York Stock Exchange (NYSE), under the oversight of the Securities and Exchange Commission (SEC), was the principal regulator of the Wall

PRP: 223.13 Lei

Acesta este Prețul Recomandat de Producător. Prețul de vânzare al produsului este afișat mai jos.

200.82Lei

200.82Lei

223.13 LeiLivrare in 2-4 saptamani

Descrierea produsului

The long-hidden history of how the corrupt Wall Street investment banks of the 1960s held Congress over a barrel and got an outrageous taxpayer-funded bailout of what they owed their customers--and how little Congress and the SEC got from Wall Street in return. This set the precedent for the bailouts of the 2008 Financial Crisis--and the next Wall Street bailout. A story of corruption and financial malfeasance, it unfolds throughout the tumultuous 1960s, during the administrations of Kennedy, Johnson, and Nixon with a surprising cast of famous and infamous characters playing roles: Abbie Hoffman, Roy Cohn, Ross Perot, Donald Regan, Michael Bloomberg, Felix Rohaytn, Sandy Weill, Ken Langone, and many others. In the 1960s, the fabric of American society was torn apart by deep divisions over the Vietnam War, violence in our cities, and the senseless assassinations of President John F. Kennedy, Martin Luther King Jr., and Senator Robert Kennedy. Civil rights, as well as women's and gay liberation movements, were challenging America. Music, literature, fashion, and "substances" were transforming the culture and upending conventional morality and manners. The public, the media, and politicians, preoccupied with these dramatic changes, paid little attention to Wall Street, where a crisis was brewing that would cause more investment banks to fail than during the Great Depression. The year 1968 should have been the best of times on Wall Street. It was the greatest bull market since the Roaring '20s. The Dow was breaking records. Trading volume was exploding. A hot IPO market for high-flying technology companies was defying gravity. And a swashbuckling mergers and acquisitions wave was generating enormous profits. Despite how flush Wall Street firms looked to outsiders, in truth, they were not a thundering herd but one in need of culling. Hidden from view was the fact that many of the best-known firms on Wall Street were in very precarious financial positions. Rather than investing in desperately needed state-of-the-art computer systems, the executives of these firms overpaid themselves, leaving them overextended and overleveraged. When business exploded in 1968, they were so overwhelmed by the stacks of stock certificates piled from floor to ceiling that their antiquated back offices were unable to process them. The New York Stock Exchange (NYSE), under the oversight of the Securities and Exchange Commission (SEC), was the principal regulator of the Wall

Detaliile produsului